Be Informed

Our Latest News

Stay informed of important issues that impact your business from taxation, accounting, markets and economy from us.

Claiming Your Input Tax : A Guide to ZIMRA’s Invoice Management System

Simplifying the New Digital Tax Frontier: A Guide to ZIMRA’s Invoice Management System The digital transformation of Zimbabwe’s tax landscape has reached a significant milestone with the integration of the Tax and Revenue Management System (TaRMS) and the Fiscal Data...

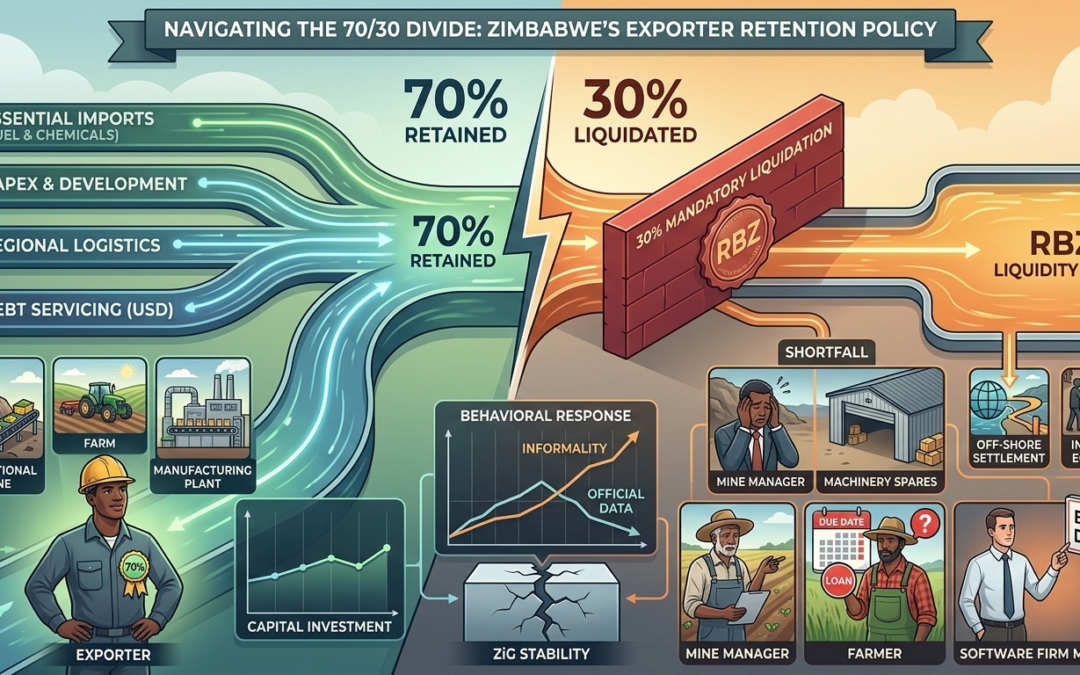

Navigating the 70/30 Divide : Analysing the 70% Retention Requirement in Zimbabwe?

Title: Navigating the 70/30 Divide: Analyzing the Impact of Zimbabwe's Foreign Currency Retention Policy on Exporters and the Wider Economy. By [Great Paraxy/Retention Policy in Zimbabwe, Lead Economic Analyst] Introduction: The Persistent Challenge of Foreign...

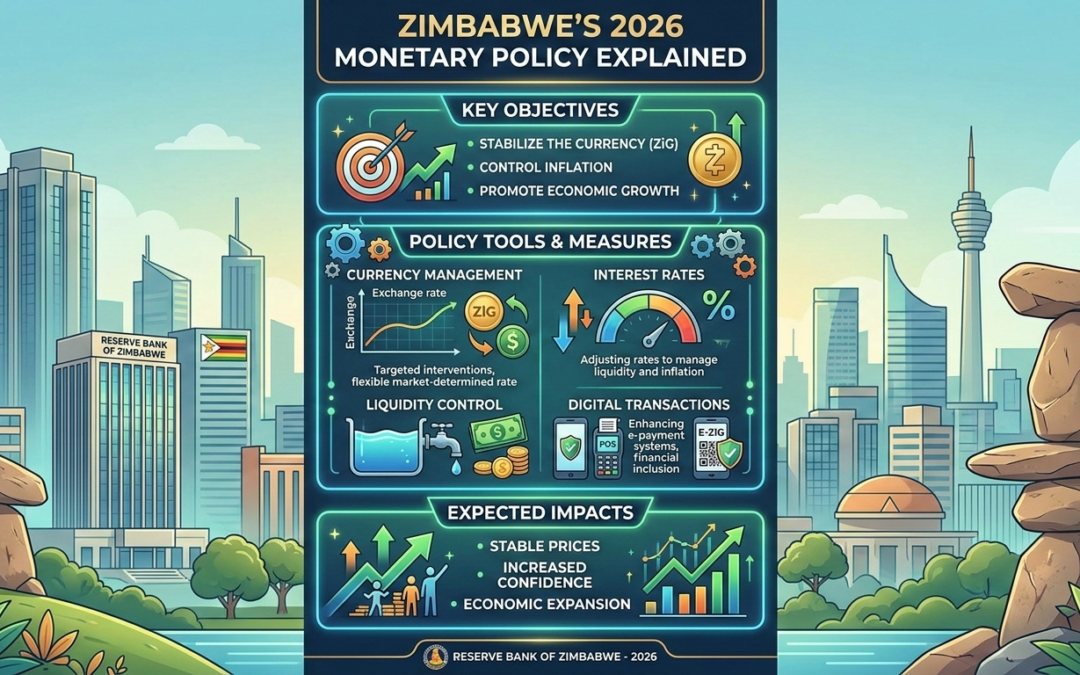

Steadying the Ship: Guide to the 2026 RBZ Monetary Policy Statement

Zimbabwe's 2026 Monetary Policy Explained The 2026 Monetary Policy Statement (MPS), presented by the Reserve Bank of Zimbabwe (RBZ) Governor John Mushayavanhu today, February 27, 2026, focuses on a strategy of "staying the course." After a period of significant...

Tax Treatment of Grants, Donations & Sponsorships in Zimbabwe.

The Conduit Trap: Navigating the Tax Risks of Receiving Third-Party Money in Zimbabwe Introduction In the dynamic landscape of modern commerce, businesses in Zimbabwe frequently encounter scenarios where they receive funds from third parties. These funds can manifest...

The “Conduit” Trap: Navigating the Tax Risks of Receiving Third-Party Money in Zimbabwe

In the world of Zimbabwean business, few things are as stressful as a surprise letter from the Zimbabwe Revenue Authority (ZIMRA) demanding an explanation for large sums of money sitting in your bank account. For many entrepreneurs, consultants, and legal...

Find More

Categories

- Accounting

- Regulations

- Tax

- Business

- Bookkeeping

- Company Formation

Follow Us

Feel free to follow us on social media for the latest news and more inspiration.