Taxation Services in Zimbabwe

We offer unmatched Tax Services from Tax Planning, Advisory & Planning. Are you having challenges with ZIMRA. Engage us for best tax services.

Compliance

We function as an extension of your tax department to streamline internal tax operations, manage costs, minimize over-payments, errors on returns, reduce risk and the likelihood of notices and averting penalties allowing them to focus on strategic issues that improve total tax performance and deliver higher organisational value.

Advisory & Consulting

Our strategic advisory services improve overall tax performance providing innovative solutions to address the issues and errors that we identify thereby creating greater opportunities for clients to improve efficiency, become more strategic in their approach to tax, and deliver outstanding value to their business.

Planning

We believe in every business decision there is a tax. We make it our business to be well versed in the latest tax legislation so we can ensure that you never pay more than you are legally obligated to. We will adopt the best tax strategic approach to your business whether new, or already established business, finding deductions available.

ENGAGE OUR!

End to End Tax Services.

Our integrated tax services improve overall tax performance creating a greater opportunities to measure and improve your efficiency, develop a more strategic approach to tax and delivering an outstanding value to your shareholders.

We offer strategic advantages that are unmatched by ordinary accounting and consulting firms. We believe in liberating companies from the burden of being overtaxed and freeing their capital to invest in their own tomorrow. Clients should only pay the taxes they absolutely owe but no more because the rest fuels their dreams of a better future. .

LUCENT

Tax Portfolio.

Tax Clearance Processing

30% withholding tax is hurting. Let us process your 2023 Tax Clearance certificate.

Bank Advice Processing

You want to instantly open your corporate account easily, engage us for your advice note.

ZIMRA Audits

Are you being audited by ZIMRA. We know their language and what needs to be done.

ZIMRA Representations

The tax authority may be intimidating sometimes. We have been working with them, trust us.

Tax healthy checks

We institute a proactive approach resolving errors and omissions with ZIMRA.

BP Number Registration

You are obliged to register with ZIMRA as soon you start trading. Be compliant.

Customs Activation

Your BPN needs to be activated for importation when registering with ZIMRA.

E-Service Registration

Returns submission and tax clearance application is now being done online.

VAT Registration

You are liable to register for VAT when your taxable supplies reach threshhold.

Transferpricing documentation

You are liable to submit a return (ITF12C2) for associated persons or parties.

Returns Submission

Let us take care of your returns for all your tax heads and worry not about penalties.

Tax Computations

Our team is readily available to assist in all your tax computations.

Tax Planning

We legally assist you maximize your deductions and utelise your loses .

Tax Recovery

Tax Advisory

We believe taxes are on every facet of business, and needs proactive not reactive approach.

Tax consulting

Latest News

Don’t Miss A Thing

The Corporate Reset: Navigating Zimbabwe’s 2026 Company Reregistration Deadline

As the April 20, 2026, deadline looms, the Zimbabwean business landscape is currently navigating one of the most...

Zimbabwe Fast Food Tax Explained

In Zimbabwe, the introduction of the "Fast Food Tax" represents a significant shift in fiscal policy, blending revenue...

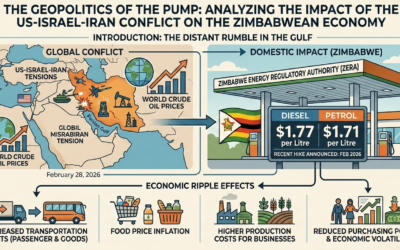

The Geopolitics of the Pump : Analyzing the Impact of the US-Israel-Iran Conflict on the Zimbabwean Economy

The Geopolitics of the Pump: Analyzing the Impact of the US-Israel-Iran Conflict on the Zimbabwean Economy...

Taxes Made Easy.Partner with us. Grow your business.

Top Of The Line

Our Favorite Clients