This public notice from ZIMRA represents a significant shift toward real-time compliance monitoring and automation. By moving to a monthly validity period for Tax Clearance Certificates (ITF263), the tax authority is effectively placing businesses under constant supervision.

Here is an analysis of the effects this will have on businesses:

1. Shift to “Continuous Compliance” Model

Previously, tax clearances often lasted for longer periods (six months to a year). The new one-month validity changes the business rhythm:

-

Operational Burden: Accounting departments must now ensure every single return (VAT, PAYE, Income Tax) is filed perfectly every 30 days. There is no longer a “buffer zone” to fix errors later in the year.

-

Zero Tolerance for Lapses: A single missed deadline or technical glitch in the Fiscalisation Data Management System (FDMS) could lead to an immediate suspension of the certificate for the following month.

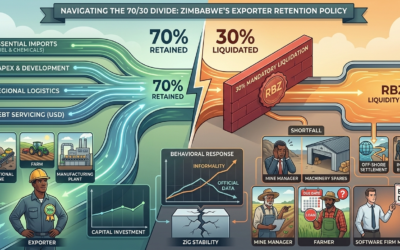

2. Cash Flow Management Challenges

The requirement for “Tax payment in full” by the due date has direct financial implications:

-

Liquidity Pressure: Businesses cannot “borrow” from their tax obligations to fund operations. They must prioritize ZIMRA payments to keep their ITF263, which is essential for receiving payments from customers.

-

Withholding Tax Risk: Without a valid ITF263, a business’s customers are legally required to withhold 30% of the invoice value. For many businesses, this 30% represents their entire profit margin, meaning a lapse in clearance could cause a severe cash flow crisis.

3. Heightened Technical Dependency (FDMS)

The notice emphasizes that fiscal devices must be operational and connected.

-

Infrastructure Costs: Businesses must invest in reliable internet and hardware to ensure daily data uploads to ZIMRA.

-

Technical Risks: If a fiscal device fails or a ZIMRA server connection drops, a business might appear non-compliant through no fault of its own, potentially blocking their tax clearance.

4. Categorization of “Non-Trading” Entities

The clarification on NIL Returns is a double-edged sword:

-

Clarity: It prevents non-trading shelf companies from clogging the automated system.

-

Access Barriers: If a company is in a startup phase (not yet trading but needing a tax clearance to bid for contracts), they must now undergo a manual office approach, which is slower than the automated process.

Summary of Business Impact

| Area | Impact Level | Business Consequence |

| Administration | High | Increased workload for tax consultants and accountants. |

| Financials | Critical | 30% Withholding tax penalty if the monthly clearance is missed. |

| Technology | Medium | Mandatory 24/7 uptime for fiscal devices. |

| Contracting | High | Risk of losing tenders or being disqualified from supplier lists due to expired certificates. |

Strategic Recommendations

To navigate these changes starting December 27th, businesses should:

-

Automate Filing: Use accounting software that integrates with ZIMRA’s requirements.

-

Audit FDMS Daily: Assign a staff member to verify that fiscal data was successfully uploaded before the end of each business day.

-

Proactive Payment Plans: If you anticipate a cash flow struggle, apply for an approved payment plan immediately, as the notice confirms these are still recognized for compliance.