ZIMRA Compliance: Your Essential Guide to Business Tax in Zimbabwe

ZIMRA compliance is a non-negotiable legal requirement for every business operating in Zimbabwe, regardless of size. The Zimbabwe Revenue Authority (ZIMRA) is the government body responsible for collecting taxes and duties, and enforces tax laws through audits and penalties. Understanding and meeting these obligations is crucial for business stability and growth.

Key Taxes Your Business Must Manage

| Tax Type | What It Is | Who It Affects | Key Compliance Tip |

| Income Tax | Tax on your business’s net profits (after allowable expenses). Standard rate is 25.72% (25% Corporate Tax + 3% AIDS Levy). | All profitable businesses. | Submit Quarterly Payment Dates (QPDs) and make provisional tax payments on time to avoid penalties and interest. |

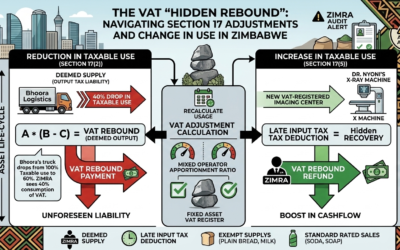

| Value Added Tax (VAT) | Tax on the sale of most goods and services. Current rate is 15%. | Businesses with annual taxable revenue over US$25,000. | Do not spend VAT collected from customers—it is ZIMRA’s money. Remit it monthly or bi-monthly. |

| PAYE (Pay As You Earn) | Income tax deducted from employee salaries using a sliding scale. | All employers. | Failure to remit correctly can make the business owner personally liable for outstanding amounts. |

| Withholding Taxes | A percentage of specific payments (e.g., rent, commissions, contract fees) that you must “withhold” and pay directly to ZIMRA. | Businesses making certain payments, especially to unregistered suppliers. | Always check if a payment is subject to withholding tax; if you fail to withhold, you must pay it yourself. |

Foundational Compliance Requirements

- ZIMRA Business Partner (BP) Number: Every business must register to get this number. It’s essential for all tax dealings, opening a business bank account, and applying for tenders. Tip: Register early to avoid backdated tax liabilities.

- Fiscal Devices: VAT-registered businesses must use these machines to record sales, which are automatically reported to ZIMRA.

- E-Filing: ZIMRA mandates the use of its online platform for submitting returns and making payments. Manual submission when e-filing is required is considered non-compliance.

How to Stay Compliant and Avoid Penalties

- Register Early: Get your Tax Identity Number (TIN) as soon as you start operations.

- Maintain Excellent Records: Keep clear and accurate records of all income, expenses, and taxes. Poor records lead to ZIMRA estimating your taxes. Do not mix business and personal finances.

- Know and Meet Deadlines: File tax returns and make payments (including QPDs) on time using e-filing.

- Keep Your Tax Clearance Valid: A valid Tax Clearance Certificate (ITF263) is necessary to secure contracts and tenders.

- Get Expert Help: Engage tax advisors or accountants to ensure accuracy and stay updated on ZIMRA rules.

- Budget for Taxes: Set aside money for taxes monthly to prevent cash shortages when payments are due.

- Respond Promptly: Immediately address any correspondence from ZIMRA.

Consequences of Non-Compliance

Ignoring ZIMRA can be costly and jeopardize your business’s future. Consequences include:

- Hefty Penalties and Interest: These can quickly double your tax bill.

- Bank Account Garnishment: ZIMRA can freeze your bank account to collect outstanding amounts.

- Audits: Non-compliant businesses are a target for ZIMRA inspections.

- Loss of Business: Inability to secure contracts without a valid Tax Clearance.

- Legal Action: ZIMRA can take extreme measures against non-compliant owners.

Compliance is more than avoiding trouble; it builds a trusted, stable, and ready-to-grow business.

Get in touch with us at Lucent and have a conversation with us.

Let’s help you stay compliant, organised, and ready for growth.