In Zimbabwe, the law surrounding deceased estates is designed to ensure that the government gets its “final slice” of a person’s wealth before it passes to their heirs. Think of it as a final financial audit by the State.

The primary laws you need to know are the Administration of Estates Act [Chapter 6:01] (for the process) and the Estate Duty Act [Chapter 23:03] (for the tax itself).

1. The Governing Legislation

-

Administration of Estates Act [Chapter 6:01]: This is the “how-to” guide. It governs how an estate is registered, how an executor is appointed, and how assets are distributed.

-

Estate Duty Act [Chapter 23:03]: This is the “how-much” guide. It dictates the actual tax (duty) that must be paid to the Zimbabwe Revenue Authority (ZIMRA).

-

Capital Gains Tax Act [Chapter 23:01]: Relevant if the estate sells property (like a house or shares) to a third party during the winding-up process.

2. Key Tax Implications (Simplified)

In simple terms, there are three main ways the taxman interacts with a deceased estate:

A. Estate Duty (The “Death Tax”)

This is a tax on the total value of everything the person owned at the time of death.

-

The Threshold: As of current regulations, estate duty is only charged if the “dutiable” value of the estate exceeds US$50,000. If the estate is worth less than this, no estate duty is paid.

-

The Rate: The standard rate is 5% of the value above the threshold.

-

Exemptions: This is the “good news” part. The following are usually not taxed:

-

The family home (Principal Private Residence), provided there is a surviving spouse or child.

-

One family vehicle.

-

Proceeds from life insurance policies (up to certain limits) if they go to a spouse or child.

-

B. Capital Gains Tax (CGT)

-

Transfer to Heirs: If a house is simply being transferred from the deceased to a beneficiary (like a son or wife) according to a Will or inheritance laws, it is generally exempt from Capital Gains Tax.

-

Sale to Outsiders: If the executor decides to sell a house or shares to a stranger to raise cash for the estate, the estate must pay CGT (usually 20% on the gain or 5% of the total price, depending on when the property was bought).

C. Income Tax

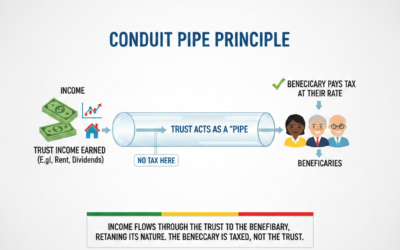

If the deceased person’s assets continue to make money after they die (e.g., rental income from a shop or interest from a bank account), the estate must register for its own tax number. The executor is responsible for paying income tax on those earnings until the estate is finalized.

Summary Table

| Tax Type | Rate | When does it apply? |

| Estate Duty | 5% | On the total value of assets over US$50,000. |

| Capital Gains Tax | 5% or 20% | Only if assets are sold to third parties. |

| Master’s Fees | ~4% | A fee paid to the Master of High Court for administration. |

Important Note: Recent updates in 2024/2025 through the Administration of Estates Amendment Act have sought to modernize the Master’s Office, making the process more digital and decentralized, which may affect how quickly these taxes are cleared.