Legislation governing Value Added Tax (VAT) registration in Zimbabwe.

VAT is an indirect tax charged on consumption of goods and services. VAT registration is guided Section 23 of the VAT Act (Chapter 23:12) which stipulates that;

(1) Every person who, on or after the 1st January, 2004, carries on any trade and is not registered, becomes liable to be registered—

(a) at the end of any month where the total value of taxable supplies made by that person in the period of twelve months ending at the end of that month in the course of carrying on of business, has exceeded five hundred thousand dollars or the prescribed amount;

(b) at the commencement of any month where there are reasonable grounds for believing that the total value of the taxable supplies to be made by that person in the period of twelve months reckoned from the commencement of the said month will exceed the above mentioned amount:

Section 23 of the finance was amended through the FINANCE ACT. No. 8 of 2022

VAT Registration Thresh hold in Zimbabwe.

Section 23(1)(a) of VAT Act,as read with Finance Act No. 8 of 2022, taxpayers are required to register for VAT if their income is over or is expected to exceed US$40,000.00 or the local equivalent at the time of registration.

Requirements to Register for Value Added Tax (VAT) in Zimbabwe.

- Be registered with ZIMRA having a BP number.

- Payments for all tax heads must be up to date.

- Completed REV 1 form

- Sales Invoices from the time of commencement of trade to date showing customers’ name and telephone numbers or confirmed and signed contracts

- Sales projections schedule for the next 12 Months

- Current stamped Bank Statement

- Letter appointing public officer.

- Valid lease agreement in the company name (if property is rented) or title deed (if property is owned)

- Sales schedule from commencement of trade to date.

What do you get after VAT Registration?

After successfully registering with ZIMRA, a tax payer is issued with a VAT Number.

What are you suppose to do after VAT Registration?

The taxpayer should ensure the following after registering for VAT;

- Issue a fiscalised tax invoices

- Levy VAT

- Submit VAT 7 return on line.

- Pay VAT Payable after computations.

- Fiscalise.

- Maintain a record of all transactions.

What are the Benefits of VAT Registration?

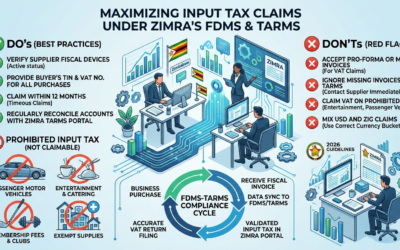

- Claim input tax from goods or services purchased from other businesses

- Tenders often require VAT number.

- VAT registered business prefer to do business with other VAT registered businesses.

- VAT registration makes a small business appear big.