The ability to claim Input Tax in Zimbabwe is governed by the Value Added Tax (VAT) Act and is crucial for managing a business’s tax liability. Here is an analysis of what businesses need to claim Input Tax in Zimbabwe:

1. Eligibility: Who Can Claim Input Tax?

The primary requirement for claiming Input Tax is that the business must be a Registered Operator for VAT purposes in Zimbabwe.

-

Registered Operator: This is a business or entity that is registered for VAT, or is legally required to be registered (i.e., its taxable supplies exceed or are expected to exceed the compulsory registration threshold, which is currently US$25,000 or the equivalent in ZiG in a 12-month period).

-

Purpose of Acquisition: The goods or services for which input tax is claimed must be acquired for the purpose of consumption, use, or supply in the course or furtherance of making taxable supplies (Standard-rated at 15% or Zero-rated at 0%).

2. Key Supporting Documentation: The Fiscal Tax Invoice

To successfully claim Input Tax, a Registered Operator must be in possession of a valid Fiscal Tax Invoice. This is a document that must be generated from a ZIMRA-approved fiscal device, and non-compliant invoices will result in a disallowed claim.

A valid Fiscal Tax Invoice must prominently display the words “Fiscal Tax Invoice” and include:

| Feature | Requirement |

| Supplier Details | Name, address, VAT and Business Partner registration number. |

| Recipient Details | Name, address, and VAT/Business Partner registration number (if the recipient is a registered operator). |

| Invoice Identification | Individual serialized number and the date of issue. |

| Supply Details | Description of the goods or services, quantity/volume, and currency used. |

| Tax Details | The value of the supply, the amount of tax charged, and the total consideration for the supply. |

| Verification | A verifiable QR Code and authentication code (as part of the fiscalisation process). |

Note: For imported goods, the supporting document is the Bill of Entry.

3. The Core Condition: Connection to Taxable Supplies

The expenditure must have a direct and immediate link to the business activities that generate taxable revenue.

| Supply Type | Input Tax Claimable? |

| Taxable Supplies | Fully Claimable (Standard-rated at 15% or Zero-rated at 0%). |

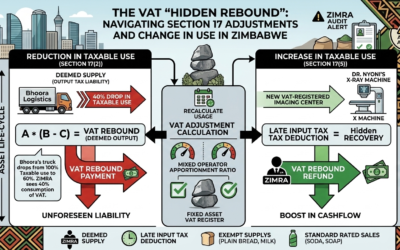

| Mixed Supplies | Apportionment Required. Input tax must be apportioned. Only the portion relating to making taxable supplies can be claimed. |

| Exempt Supplies | Not Claimable. VAT incurred on goods/services used to make exempt supplies (e.g., medical services, residential rentals, domestic electricity/water) cannot be claimed. |

4. Prohibited/Disallowed Input Tax Deductions

The VAT Act specifically disallows Input Tax claims on certain goods and services, even if the business is a Registered Operator. Key prohibited deductions include:

-

Passenger Motor Vehicles: Input tax on the purchase or importation of passenger motor vehicles is generally prohibited. (This exclusion often does not apply to commercial vehicles like delivery vans or pick-up trucks used for business).

-

Entertainment: Input tax on expenditure incurred on entertainment, including hospitality in any form (e.g., lunches for business associates), is generally prohibited.

5. Other Important Requirements

-

Time Limit: The claim must be made in the VAT return for the period the return is due, or within 12 months from the date of the fiscal tax invoice, whichever is the longer period.

-

Record Keeping: Registered operators must maintain detailed records (including all Fiscal Tax Invoices, credit/debit notes, and Bills of Entry) for a minimum period of six years for ZIMRA verification.