End to End Tax Compliance Services in Zimbabwe.

We strive to keep abreast of ZImbabwe’s changing legal tax environment so we can provide up-to-date support and value-added solutions to our clients.

Top Of The ART

ZIMRA Compliance Services

How we can help your business?

We clearly understand the challenging business and demanding regulatory environment we are in. Our compliance service offering being responding to compelling clients’ needs from registrations, consulting, advisory, planning, computations and timely submissions of various tax heads such as Value Added Tax, Income Tax, Withholding, Capital Gains and Transfer Pricing.

Tax Clearance Processing

We assist in processing Tax Clearances.

Single Account Change

You want to switch from one bank to another.

ZIMRA TIN Registration

Register with ZIMRA to get Tax Identity Number.

BPN Customs Activation

Activate your BPN so that you can import.

TaRMS Registration

Income Tax Return (ITF12C)

Transfer Pricing Return (ITF12C2)

Computing and filing your ITF12C2 return yearly on time to avoid penalties.

Provisional Tax (ITF12B)

ZIMRA VAT Registration

Taxpayer liable to register for VAT when taxable supply reaches USD25,000.00

Statutory Registrations

Computing and filing NEC,NSSA, SDF,ZIMDEF returns to avoid penalties.

Tax Audits and Representations

Pay As You Earn (P2) Returns

ITF16

CGT 1

REV5

REV 2

VAT 7 Return

VAT 10 Return

why!

Lucent Compliance Services.

These days, the risks of overlooking tax liabilities have never been higher, and the benefits are quite compelling for companies that can prove compliance. Furthermore, business are facing serious budget deficits,ZIMRA is becoming more aggressive in seeking businesses that are neglecting their tax obligations.

If you think of taxes as something to minimize or even avoid, it’s time to think again. Tax compliance has traditionally been viewed as a necessary evil by many companies.

Our tax compliance and advisory methodology provides businesses with an efficient way of handling their tax compliance workload and meeting deadlines. Services are commonly bundled with finance and accounting

to create a turnkey compliance and reporting solution.

Our professionals efficiently prepare monthly tax returns for our clients and promptly respond to taxability and compliance questions to ensure complete communication and coordination with the client, and provide management reports as needed to support business activities

Latest News

Don’t Miss A Thing

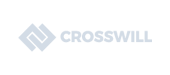

Analysis of the ZIMRA FDMS versus other SADC members

The landscape of tax administration in Zimbabwe has undergone a seismic shift with the introduction of the...

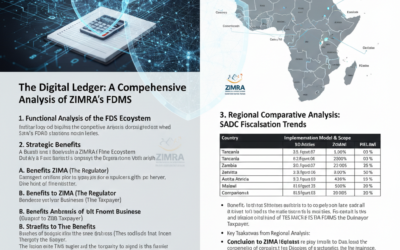

What TaRMS and FDMS Mean for Businesses : A Warning to Businesses.

Navigating the Digital Tax Frontier: What TaRMS and FDMS Mean for Businesses The implementation of the Tax Risk...

VAT exemptions under SI 15 of 2024

Statutory Instrument (SI) 15 of 2024, gazetted on February 9, 2024, serves as a major refining act for...

Take your Business to another Level....

Top Of The Line

Our Favorite Clients